AFYA Insurance

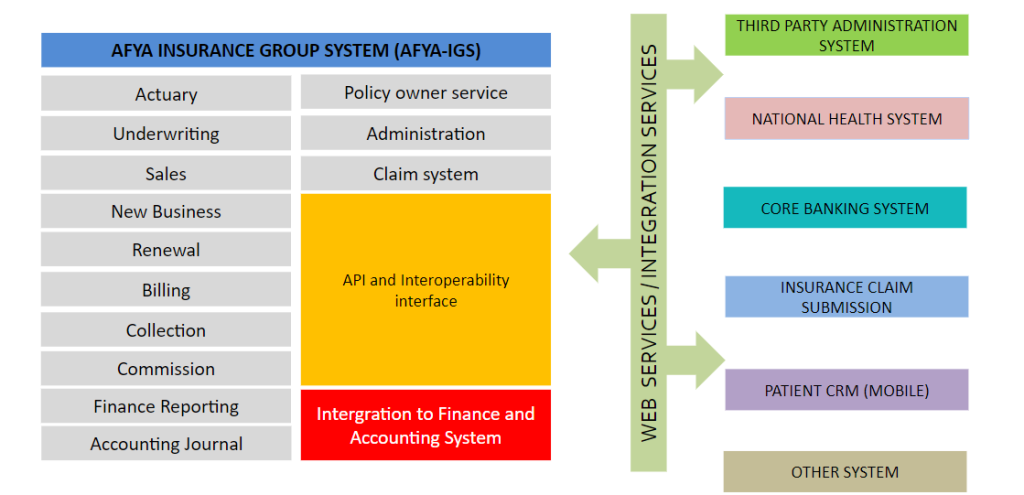

a comprehensive software solution designed to manage and automate the various processes involved in the insurance industry.

We understand that managing insurance policies can be complex and time-consuming. That’s why we’ve developed a comprehensive Insurance Management System (AFYA INSURANCE) designed to streamline your operations and enhance your customer experience.

Our state-of-the-art platform offers a range of features tailored to meet the needs of insurance agencies, brokers, and policyholders. From automated policy management and claims processing to real-time analytics and customer support, our system ensures that you have all the tools you need to succeed in today’s competitive market.

Key Features:

- Automated Policy Management: Simplify the creation, renewal, and cancellation of policies with our intuitive interface.

- Claims Processing: Expedite claims with automated workflows and real-time tracking.

- Customer Portal: Provide your clients with 24/7 access to their policy information and support.

- Analytics & Reporting: Gain insights into your business performance with customizable reports and dashboards.

- Compliance & Security: Ensure your data is protected with our robust security measures and compliance with industry standards.

Join the many satisfied clients who have transformed their insurance operations with our innovative solutions. Explore our Insurance Management System today and discover how we can help you achieve greater efficiency and customer satisfaction.

Reasons Switching to AFYA Insurance

- More than 10 years experience in healthcare industry.

- Existing systems do not guarantee that all the necessary information is available when and where it is needed.

- Existing systems are difficult or not integrated so that with many logins and different interfaces, it burdens the users who use them, as well as patients.

- Existing systems hinder the ability of insurance to measure outcomes effectively and implement standardized process, which in turn slows revenue growth.

- Availability of a dedicated and comprehensive online training module using the proven open Learning Management System, namely edX. This online training has been divided into roles and modules, making it easy to use.

AFYA Insurance Overview

Covers group life and health products

Product Setup

- Product management and customization

- Benefit

- Premium Setup

- Custom plan with Family Limit

- Administrative service only (ASO)

- Term & Condition

- Profit Sharing

- Reinsurance

Policy Holder

- Proposal

- Underwriting

- Policy setup

- Policy document

- Membership

- Member addition / alteration / deletion with upload function:

- Product

- Plan

- Limit amount

- Termination / deletion with premium refund

Membership certificate

- Proposal

- Underwriting

- Policy setup

- Policy document

- Membership

- Member addition / alteration / deletion with upload function:

- Product

- Plan

- Limit amount

- Termination / deletion with premium refund

Renewal

- Termination / deletion with premium refund

Billing Premium

- Create billing (new business, renewal, movement)

- Billing notification

- Additional billing (letter, invoice, report)

- Billing correction and adjustment

- Collection of billing premium from policy holder and member.

- Sales management

Agency, broker, referral - Commission setup

- Commission calculation

- Commission aggregation

- Commission adjustment

- Commission payment

- Commission refund

Policy owner service (POS) modules

- Create billing (new business, renewal, movement)

- Billing notification

- Additional billing (letter, invoice, report)

- Billing correction and adjustment

- Collection of billing premium from policy holder and member.

- Sales management

Agency, broker, referral - Commission setup

- Commission calculation

- Commission aggregation

- Commission adjustment

- Commission payment

- Commission refund

Integration to agency system

- Create billing (new business, renewal, movement)

- Billing notification

- Additional billing (letter, invoice, report)

- Billing correction and adjustment

- Collection of billing premium from policy holder and member.

- Sales management

Agency, broker, referral - Commission setup

- Commission calculation

- Commission aggregation

- Commission adjustment

- Commission payment

- Commission refund

Integration to TPA systems (member from enrollment) and accounting / finance system using file / API

- Create billing (new business, renewal, movement)

- Billing notification

- Additional billing (letter, invoice, report)

- Billing correction and adjustment

- Collection of billing premium from policy holder and member.

- Sales management

Agency, broker, referral - Commission setup

- Commission calculation

- Commission aggregation

- Commission adjustment

- Commission payment

- Commission refund

Reports, letters, and dashboard

- Create billing (new business, renewal, movement)

- Billing notification

- Additional billing (letter, invoice, report)

- Billing correction and adjustment

- Collection of billing premium from policy holder and member.

- Sales management

Agency, broker, referral - Commission setup

- Commission calculation

- Commission aggregation

- Commission adjustment

- Commission payment

- Commission refund

Claim (next project)

- Cashless

- Membership data

- Claim verification

Excess claim management - Reporting to TPA

- Claim list

- Claim payment

- TAT

- Internal claim checking and validation process

- Claim payment

Reimburse - COB (BPJS & Other insurance)

- Provider management

- Term and condition

- Hospital discount

AFYA Insurance Technologies

- Platform: Java based, using Spring Boot 2.6.7, which can be deployed on premise or cloud

- Application Server: Tomcat 8.5

- Framework: Spring Boot

- Database: Oracle 11

- User interface: HTML, CSS, JavaScript, AJAX, jQuery

- API: RESTful Web API

- Operating System: Linux / Windows

- Server: REHL 8 / Ubuntu 13 / Microsoft Windows Server 2019

- Client: Windows 10 / 11 / Linux